We’ve got so much to share… where to begin?

We’re excited to release Growing With Purpose – the Medicus Pension Plan 2025 Annual Report. You’ll hear from a few of our members, learn what’s new at Medicus, and get a look at the strong financial foundation that supports it all.

We’ve built a strong, diversified strategy for the Medicus Pension Plan, designed to withstand periods of uncertainty while maximizing returns during periods of prosperity.

Some standout highlights? Our funded status was a healthy 152% on a going-concern basis as of January 1, 2025, and our investment return for 2024 was 9.1%, well ahead of our 5.8% benchmark.

Plan enhancements for members

With a robust funded status that places us among Canada’s strongest pension plans, Medicus is thrilled to announce:

- We will be providing our first inflation increases

- We added two new benefit features for our plan members and their families

1. Inflation increases

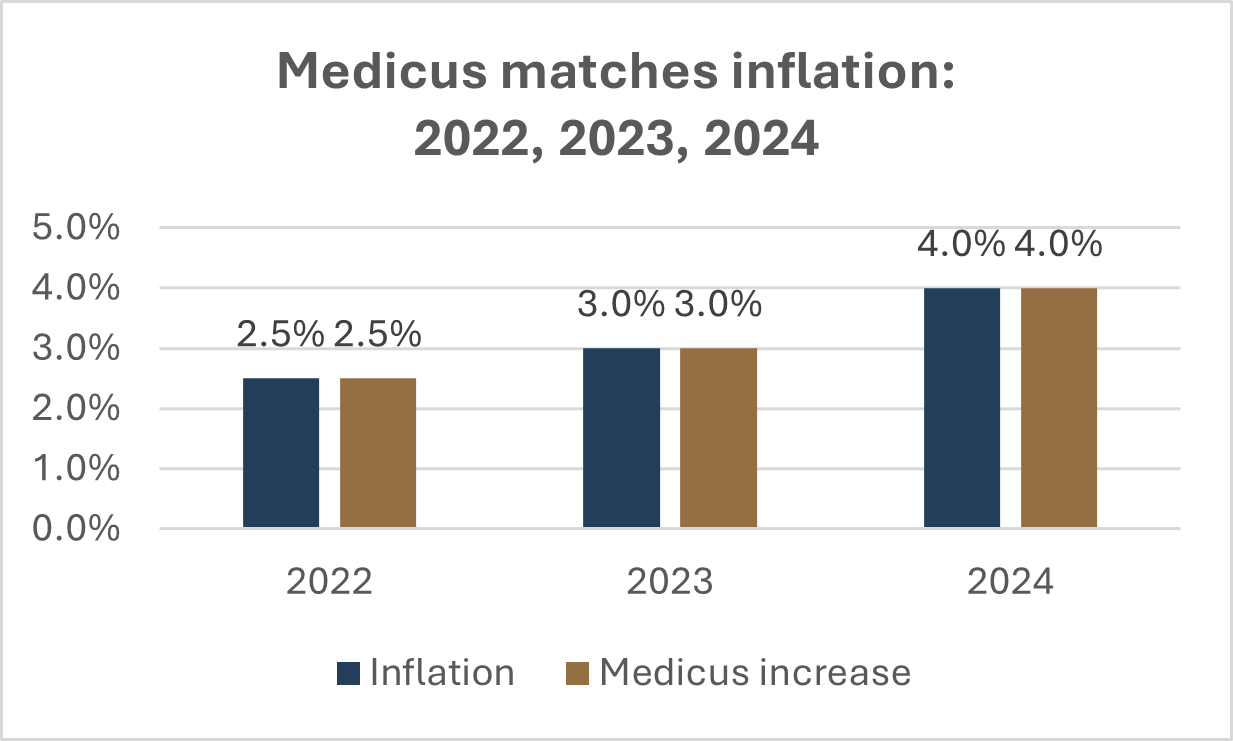

A key feature of the plan’s design is the ability to provide inflation increases to help our members’ pensions keep pace with the rising cost of living, preserving their value over time.

Whether retired or still working, everyone benefits:

Active members receive increases for the years they’ve contributed to the plan.

Retirees receive a 2.7% boost in their monthly pension payment, starting July 1, 2025.

Bonus: Members who participated in the 2024 buyback program will also receive a 4.0% increase for each additional year of pension they purchased.

Inflation increases in action

This illustration shows the impact on the annual pension, payable at age 65, for an active member who:

- Joined Medicus in 2022

- Earned the maximum pension each year

- Completed a buyback in 2024 to increase their pension at age 65 by $20,000

|

Annual pension |

2025 inflation increase |

Adjusted pension

|

|---|---|---|---|

2022 |

$3,420 |

$337 |

$3,757 |

2023 |

$3,507 |

$250 |

$3,757 |

2024 |

$3,610 |

$147 |

$3,757 |

Buyback in 2024 |

$20,000 |

$813 |

$20,813 |

|

$30,537 |

$1,547 |

$32,084 |

And we’re just getting started. Our plan is built to allow inflation increases when the financial health of the plan supports them.

2. New benefit features

We know how important it is to protect not just our members, but the people they care about most.

That’s why we’re excited to share two valuable new guarantee period enhancements.

Here’s what’s new:

- Increased base pension guarantee from 10 years to 15 years

With this option, if a retired member passes away before receiving 15 years of pension payments, the remainder will go to their designated beneficiary or estate.

Good to know: Assigning a beneficiary(ies) leads to faster payment, since the amount will bypass the probate process.

- 10-year guarantee period added to the 100% spousal option

With this option, if a retired member passes away, their spouse will receive 100% of their pension for life.

New! If both the member and their spouse pass away within the 10-year guarantee period, the remainder will go to the designated beneficiary or estate.

With guarantee periods of at least 10 years now included as part of every pension option, Medicus offers its members the certainty that no matter what happens, physicians and their families will benefit from the financial protection built into the plan.

Thank you to those who’ve joined the growing community of physicians who participate in Medicus. We are deeply committed to our purpose of providing physicians (and their families) with financial peace of mind, allowing them to spend more time where it matters most.